Personal Finance Instruction

This document contains my amateur opinions for building wealth and retiring as early as possible. Note that these are the opinions of an engineer / computer scientist, not a professional CPA, investment advisor, or attorney.

See full disclaimer before making any financial decisions based on this content.

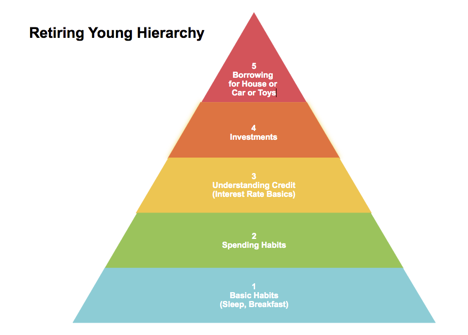

Here’s a hierarchy that I believe is most important to understand for growing your personal wealth. The rest of this document describes these concepts starting at the foundation. I suggest you do not skip sections as each section forms the foundation for the next. You would not want a house with garbage for a foundation, do not build your financial future on a shaky foundation either- read this from the start and be sure you thoroughly understand each section before proceeding to the next.

Basic Habits

Your basic habits are like the foundation of a house. They’re not flashy, they’re generally not visible, and you can skimp on them and still have what appears to be a beautiful house on top. However, just like a beautiful house, if the foundation sucks then cracks will start to appear when there’s a slight earthquake (i.e. life event). If the foundation is not repaired, the house will eventually fall down or cost a lot to repair. So in order to retire young, or if you’re already older and want to retire well instead of eating cat food and watching TV all day because you can’t afford to enjoy life, don’t skip the basics.

Sleep

It may sound silly, but lack of a regular sleep pattern is proven to negatively impact your mental prowess and emotional stability. Lacking either of these is a critical weakness in your foundation. Have a bed time, go to sleep within an hour of that at least 5 nights a week. Get the amount of sleep YOUR body needs. If you need 8 hours to get up refreshed and you need to be at work at 7, you better be asleep before 10. If you wake up after 7 hours bright eyed and bushy tailed every day, lucky you- plan accordingly. Skimp on this by setting an alarm and guzzling coffee every morning if you want to perform at a level that will make sure you’re working until you die.

Breakfast

This section is opinion and numerous successful people skip breakfast, but if you’re struggling with later sections, you might try it.

Eat breakfast at home. Every weekday. Unless it’s a holiday I suppose. Don’t give any BS excuses about “I’m not really hungry until later”, “I don’t have time”, “I love McDonald’s/Starbucks/Other BS”, etc. A reasonably healthy, unhurried breakfast will set your mind and body on an even keeled path for the day. Skipping it will leave you vulnerable to emotional fluctuations and the resulting poor decisions, hunger when you should be concentrating on kicking ass at work, your memory will be impaired, and you will weigh more with an increased risk of type 2 diabetes. You will make spontaneous foolish purchases that squander your wealth because you’re not thinking clearly. Want to retire young and not be fat? Start adulting and eat your breakfast- at home. Every weekday without fail. Go eat some garbage at a restaurant on one weekend day if you must.

Spending Habits

It may sound crazy, but just like eating more calories than you burn will make you overweight, spending more money than you earn will make you poor. Want to not be poor and overweight? Spend less money than you make, and don’t eat more calories than you burn. Sounds simple enough that every idiot should get it, but if you look around- you’ll notice a large percentage of people who appear not to understand these basics. If you talk to them though, you’ll find that it’s generally not a lack of understanding as you might first assume, it’s actually usually a lack of will power (and occasionally a disease in the case of excessive weight, to be fair). They will often have excuses that they firmly believe though, people are amazing at making justifications for not changing their behaviors. Take a hard honest look at yourself to see if you’re having trouble with these.

I Want I Need!

Here’s where people fall down on these two simple concepts. They want/need the most expensive car they can afford, that burger with extra cheese/bacon, a bigger house than their neighbor, pizza, fufu coffee, etc. These are not evil things, but needing the house bigger than their neighbor- that’s probably going to keep you working endlessly. And really, pizza is worth the exercise required, let’s face it.

You need to decide who you are and what your priorities are. You want to work until you die? Spend every dollar you make before you even have it. You laugh, it won’t happen to you, but I sold cars as a kid for a summer and saw it in black/white. Time and again. People would come in with $2000/month in earnings, with $1700 of it spoken for by rent/mortgage and various other payments, and want to get the most expensive car they could get as long as the payment was $300 or less. Those people will work until they die with no big vacations, no peace of mind, and always hungrily watching their bank account for their next paycheck to deposit. I don’t even want to think about what happens when their company has to lay them off, or their kid gets really sick- but I guarantee it’s not pretty.

That said, if your self worth is tied to the vehicle you drive up in, or the size of your house- retiring early is probably not for you. Be honest with yourself, there’s nothing wrong with those things, and you only live once so be happy. For me, I don’t care about those things, so it was easy to save more than I earned.

Making Reasonable Choices

Here’s the terrible truth you were hoping I’d have a magic shield against, but if you want to spend less than you make then you’re going to have to make some compromises with yourself (and your partner). Oh the horror.

Think of the general places your money goes: roof over your head, car, food, utilities, student loan, toys, clothes, vacations, etc. There’s a LOT we spend our money on. And you don’t want to try to save every dollar you make either- life is for living! And you could get run over by a bus when you’re 40. So live a little, but don’t plan on that bus saving you from not working until you’re too decrepit to get out of bed. Plus, if you do this right and retire when you’re 41, you have a lot of time to live well and do what you want when you want.

How do we do that? Compromise. There’s that nasty word again. Pick some things that make you happy and have them, and compromise on the rest so you spend less than you make. Every month unless your dog goes to the vet maybe.

Compromise in Detail

What does this mean in practical terms? It means some math. Boo. Let’s take that fancy coffee you get every morning on your way to work. It’s $5 (buy stock in Starbucks, they are parting fools from their money like clockwork). If you buy it 5 days a week, 52 weeks a year, that’s $1250 a year. Let’s say you’re 21 and you want to retire when you’re 41, and you invest in the S&P 500 which has averaged 10% since 1950. We’ll talk about how to calculate this later, but know that skipping that crap means an extra $79,760 dollars in your account when you’re 41. Minus capital gains taxes, but still- that’s a healthy chunk. Make coffee at home.

$5 seems small and insignificant until you do a little math with it. Apply this to your general spending. Splurge once in a while, live a little. Just like you can’t always be on a healthy diet, you need to eat some garbage once in a while because it’s fun- so it is with spending.

Bring this thought around to your pile of expenses from earlier: roof over your head, car, food, utilities, student loan, toys, clothes, vacations, etc. Splurge on a couple things, compromise on the rest. Look around for a cheaper cell phone plan. Retire earlier. Drive an older car. Retire earlier. Turn off lights you’re not using. Retire earlier. Don’t get hooked up with a spouse that spends more than they/you make. Retire earlier. But if you’re doing those things and NEED a boat, get one but try not to go crazy on it. Or go to Italy for 3 weeks.

Spend less than you make, every month (except for that trip to Italy). Your future self will thank you.

Understanding Credit and Interest Rates

First, people aren’t loaning you money because they like you. They’re loaning you money to enrich themselves. If you want to retire early, make sure to give them back as little as you can!

The foundation of credit, and why people loan you money, is “interest”. The word is self explanatory if you think about it- it’s why someone is INTERESTED in loaning you money. Because you pay them to be interested in loaning you money with interest. You pay interest on the money you currently owe them, which is called “principal”. The amount of interest dollars paid is determined by the “interest rate”.

Compound Interest

Wake up. Right now! While these two words may sound horribly boring and tempt you to yawn and go waste time on Facebook, the concept they convey is what separates 99% of the rich from the poor. The vast majority of rich people understand and take advantage of compound interest and the vast majority of poor people do not. Yeah, there’s probably a lot of wealthy athletes who don’t understand this but the only reason they’re wealthy is because they made massively more than they spent. But you’ve also read about the ones who were broke 10 years later- they really didn’t understand this at all. I digress.

Compound Interest is what happens to a loan over time. Here’s a simple example where you have an investment and the annual interest rate is 10% (makes the math easy). You start with $10000 (the principal). So you end up with the principal you started with, plus the principal times the interest rate- where 10% means 0.10 on a calculator. So 10000 + 10000 * 0.1, which is 10000 + 1000 = 11000. So you made a thousand dollars the first year. Big whup! I could have done a lot with that ten grand and a year later all I have is a lousy thousand?? Here’s where the magic starts in year 2 by compound interest. Now you have 11000 + 11000 * 0.1, which is 11000 + 1100 = 12100. So this year you made 1100. So what you ask? If you run this out to 10 years, it’s $25937. OK, interesting right? In 20 years- it’s $67275.

WHAT??? REALLY??? No, not really. Actually it’s MORE because I simplified the math to only compound once per year. If the compounding was instead calculated monthly, which is common for mortgages and some other loans, then it would be $73280. If it was compounded 253 times per year, which is the number of days the stock market is open, then it’s $73861- not a big leap from the once a month compounding. So whether interest is compounded yearly or monthly matters, but beyond that not really.

This is why most rich people are rich. They spend less than they make and they understand the power of compound interest and apply it throughout their financial transactions. Where does all this fabulous wealth come from? Is the government giving it to them??? No. It’s from the millions of poor folks that don’t understand this but want the biggest house and fanciest car they can squeeze into their monthly paychecks and are willing to work until they die to have them.

Maybe you want to scroll back up to that section on Compromise that you skimmed through and read it again- that’s where your principal is going to come from. If you don’t see why that Compromise section was important yet, perhaps you might read the section on Sleep and Breakfast and come back in a couple weeks when your priorities have improved and you can think clearly. We’ll come back to how to take advantage of compound interest through investments later, after you understand how to avoid being on the WRONG side of compound interest.

Credit

So the fun example above is how you get wealthy. Making a wrong move with credit is a great way to stay poor because you’re the source of someone else’s compound interest. But I want and I need!!! Take a breath and scroll back up to Compromise and Compound Interest, and then come back here.

Credit is not the devil when used properly. We’ll talk later about credit for cars/houses/college (called loans), but for now let’s talk about credit cards. These have separated poor people from VAST sums of money. Here’s a quote from debt.org “Credit-card loans crossed the $1 trillion mark, reaching $1.08-trillion in Q3 of 2019”. And another good one “On average, each household with a credit card carries $8,398 in credit card debt.” With an average interest rate on new credit cards being 19.21%, you can see they’re heavily on the wrong side of compound interest. Remember how fabulous 10% was for our investment? With 19.21% interest, this is how they nail you to the wall. If you paid that minimum $25 payment, you’d be at around $9900 a year later.

Of course, they won’t let you keep paying that $25 for long. The minimum payment is usually $25 or 1-2%, whichever is higher. When you owe $9000, 1% is $90 per month. So the bill goes up and up and you just keep paying. Compound interest.

That’s horrible! I’m never getting a credit card!!! Now hold on. Wealthy people have credit cards and they’re not dragged through the mud like this. So do smart people who aren’t wealthy yet but are likely to be eventually. Why? Because they pay it off every month. Credit cards compound monthly, so if you pay it off every month you do not pay a single penny. Not a penny. Why do the credit cards allow this? Aren’t they losing money on those people? No, for two reasons. 1- the credit card companies charge a percentage to merchants for a purchase. So when you spend $100 the store only gets around $97. And #2- they’re waiting for you to stumble!

This is the great danger of living paycheck to paycheck with credit cards in your hands. When you stumble- when you have a car accident, when your water heater quits, when a family member or pet without insurance gets sick, whatever… the credit card company does a little dance because they catch you and now you’re carrying a balance and that 19.21% gets to have its way with you. You think in a couple months you’ll have it sorted out, but you don’t.

About half of Americans pay their credit card every month, so they have $0 out of that $8398 average debt- meaning those actually carrying debt are holding about double that. So just to break even on their interest and not get further in debt (treading water), they have to pay about $3200/year or $267/month in interest. If they just paid that much, they’d have to pay forever. Someone who was living paycheck to paycheck before they got in debt… where is that money coming from? They’re selling that car they wanted so bad, or their house, or a kidney? Bankruptcy you say? Not so fast. In 2005, our Congress+President passed BAPCPA (google it). Long story short- sorry middle class, you’re not getting all the way off that hook any more.

The point is, whatever you do in life, do NOT live paycheck to paycheck and have a credit card. They will get you sooner or later.

Is there any hope???

Yeah, thankfully it’s actually not hard. Scroll back up to the Compromise section and REALLY read it. Think about it. Make some choices. Eat rice and beans if you have to, but save up at least 2 months worth of your normal expenses and put it in the bank. This is your safety net against the credit card companies and their 19.21% weapon, so 2 months is really the bare minimum until you get some investments going. Do NOT let your balance fall below that. If you can’t figure out how to do this, try the Sleep and Breakfast plan for a while- power up your brain. If you’re saying to yourself “this guy is just out of touch with reality and doesn’t know my situation, I can never get ahead” but you’ve been to Starbucks in the last couple days or bought a $7 beer at a bar lately or been out to eat at a restaurant this week or have a car that’s less than 5 years old or you’re making excuses regarding Sleep/Breakfast- you are your own problem. You can have those things, they’re not bad, but if you’re doing that without a safety net then you are compromising your financial future over your immediate wants.

Now with your safety net, when your car’s transmission blows up and it costs $2000, it’s annoying and your safety net takes a hit and you may have to cut back on going out to eat to build it back up again. But the credit card company doesn’t get their claws in you and steal your future earnings to make themselves rich. Do not slack on restoring your safety net. Your financial future rests on pure chance that something else doesn’t go wrong during that period. Lower the odds by restoring it ASAP.

Investments

Once you manage to save enough money so that you’re not going to be homeless if you miss a few paychecks, you need to decide how you’re going to start investing your money so you can retire young. The basic concept you need to know is that higher return investments are riskier than lower return investments. Think about the phases of life and risk you can tolerate- when you’re 25 if all your investments went in the toilet, big deal! You can just try again and keep working like you were anyway. So you should generally take higher risk investments so even though they may go up and down like a roller coaster, by the time you’re in your 40s they’ll be worth a LOT more than lower risk investments. It may have gone in the toilet in your early 30s, but these things are generally cyclical so you ride the recovery up too. However, when you’re 75 and really don’t want to (or can’t!) be working any more, you better play it safe with your investments so when the market takes a nosedive you don’t have to start eating cat food.

If you don’t understand compound interest yet, you really need to do so. None of this will make a lot of sense if you don’t. For example, here’s a calculator to play with, but if you don’t like it then google for “compound interest calculator” and try another one. https://www.investor.gov/additional-resources/free-financial-planning-tools/compound-interest-calculator Try a variety of interest rates and contribution amounts and generally use “monthly” or “daily” as your compounding frequency. Use something practical like 20 years as your horizon. Unless you get really lucky, it’s going to take a while. You need to understand this sort of intuitively so you can have a feel for how much a percentage point matters in the long run.

Inflation

Inflation determines how much money is worth in the future. For example, do you remember what you could buy with $100 20 years ago? A lot more than you can today. The reason is inflation. Prices for gas/groceries/etc. go up, people want raises at their jobs, etc. Think about this for a minute, it’s really important for investment and loan strategies to make you wealthy. If the price of gas goes up from $2 to $4, and the price of a fastfood hamburger goes up from $1 to $2 (or whatever), and everything sort of follows this path, then basically over the same period you need to double your wages to have the same buying power you did before. So if you kept $1000 under your mattress from 20 years ago, and you pull it out now- you still see $1000, but guess what? It’s only worth what $500 was 20 years ago. You LOST MONEY! With it just sitting under your mattress and looking exactly the same! Pretty messed up isn’t it?

You may read about how the middle classes wages have stagnated, but not really understood what that meant. This is why. If you were making $10/hr 20 years ago and you’re making $20/hr now, you have the same buying power as you did 20 years ago even though your paychecks look twice as big. Because of inflation. I am using 20 years as a round number to make it easy to think about, but of course it fluctuates, sometimes it’s a little more of less. But for the last 40 years it has averaged 3.22%, which is doubling about every 20 years. Don’t expect it to be exact all the time, but keep it in mind as a general guideline.

Here’s a thought to keep in mind as we go, try to remember that it’s about 3% per year. if your investments are making less than 3% per year, you’re LOSING money even though the numbers go up!!! If you’re elderly, that may be ok as you don’t want much risk. But if you’re under 50… you’re really hurting your retirement horizon by not paying close attention to this.

The Banks

Back in the day you could get a savings account with rates much better than inflation, so this made a lot of sense to park your money. Risk free and it still went up- beautiful. A great place for seniors to park their hard won cash. No longer! The average savings account in the US as of November 2019 has an interest rate of 0.32%. Yeah, about 10 times less than inflation. Let’s say you’re getting ready to retire and you have a million dollars in the bank. Pull up your favorite compound interest calculator and let’s plug in that million dollars with a 15 year horizon because if you’re 65 hopefully you’ll live until you’re at least 80, right? Use monthly compounding and zero contributions- play around with negative contributions for living off it too! Now try 3.22% for inflation, and then 0.32% for a savings account. You should get about $1.6 million with inflation- that means that in 15 years if you have less than $1.6 million you’ve effectively lost money. With the savings account? $1.05 million. So you’ll have lost over a third of your buying power from your hard earned money over that time. That’s without making any withdrawals.

If you’re relatively young, or at least not planning to die in the next 2-3 years, if you’re not thinking you better never put a penny into a savings account at this point… stop reading, go out and buy a beer, and plan to work the rest of your life. If you are working and putting your money into a savings account, in time the principal in your account will have such a loss from inflation that it will equal the amount you’re putting in every month. In effect, at that point, every dollar you throw into the savings account might as well LITERALLY go in the toilet because you’ll be losing buying power due to inflation at the same rate you’re saving!

Where’s all your money going in your “savings account”? The bank is investing it, and making money off of it. Only they’re pocketing nearly all of the profits and giving you a silly pittance… pittance is probably not even the right word, as to me it implies even more than you’re getting from the bank. You think they pay all those people, build those pretty buildings, pay their stockholders, and more, just because they like you? They’re like Vegas without the flashing lights and a longer horizon. But make no mistake, they’re taking your money just the same.

Your House

If you own a house, you probably think it’s a good investment. To be sure, it beats the snot out of a savings account, and it does beat inflation, so that’s good. But it doesn’t beat inflation by much in the long run. Everyone has a friend who “made a killing” on their house over just a few years that one time. It happens. If you’re in the right market at the right time, it can be a great ride. But on average over the long run, it’s a snoozer. Here’s a great graph of home prices that are inflation adjusted to 2019 dollars to show why: https://www.multpl.com/case-shiller-home-price-index-inflation-adjusted Let’s say you were lucky and bought your house in 1945 when the index crossed 100 and continued up (conveniently forgetting the 50 years of slow decline before that), now the index is at 203. So in 74 years you doubled your money (accounting for inflation). Um… yay?

Inflation is basically the reason people incorrectly think it’s a good investment. If you bought a house for $250k in 1999, and it’s worth $500k in 2019- wow, hell yeah, you doubled your money and made $250k just by living there!!! Right!? Wrong. That’s just inflation. Because that 500k is now worth what 250k was in 1999.

It’s not all doom and gloom though. Here’s the sweet part of the deal. Assuming you had a mortgage, you didn’t plunk down $250k in 1999. You borrowed most of that. So the $1500/month payments you were making in 1999… today although the number is still $1500/month you’re really only paying half the value due to inflation. You’ve gotten raises since then, hopefully a lot of them. Of course you’re still really only making the same in terms of buying power because the truly wealthy are screwing you and the rest of the middle class pretty hard. But still, the dollar portion of your paycheck that’s going to your mortgage today is a lot less than it was when you started. So if you stay in your house a long time, it really helps.

This is hindered somewhat depending on the interest rate you got. But in recent years with interest rates in the 3-4% range, you’re right around inflation. It’s practically free money. If you like to move around a lot though, this is not for you. The transaction costs in buying/selling a house eat up years of the gains in value. We’ll talk more about this later in regards to buying a house.

Company 401k

Does your company provide matching 401k benefits? If you don’t know, flick yourself on the ear and then find out. If they do provide it, but you don’t take advantage at least to the minimum percentage to get all of their matching dollars- ask someone nearby to slap you upside the head. I’ll wait. If you’re busy making some excuse about you can’t afford a 3-6% “pay cut” to get their matching dollars- ask that person nearby to slap you twice, and harder.

If your work is offering you free money, you TAKE IT! It’s like turning down a pay raise to not get that money, sheer financial madness. Especially since it’s pretax dollars, so since your income is likely to be lower when you’re old, you can pull the money out then, and pay less taxes on it. Typically, they give some percentage, like 3% of your income that they’ll match. But to get that 3% (or whatever), you’ll have to save 3-6% of your income to get it. This is what trips foolish people up because they want to spend every penny they get as soon as they get it, so they can’t put aside 3-6% for when they’re old. I don’t know, maybe they imagine they’ll die first or never get old and won’t have to eat cat food on whatever is left of Social Security. Usually though, they are masters of excuses for why they need to spend exactly what they make. There are people out there making HEAPS of money at work who are deeply in debt; it doesn’t matter what you make- some people will manage to spend it all and more and honestly believe they have to. Don’t do that if you want to retire early. Stop with the excuses.

Let’s face it, you’re gonna be old at some point, so even though you don’t want to touch that money until you’re 59.5 years old, this money will form part of your portfolio- it’s just the part you won’t be using until you’re beyond that age. When you are setting up your 401k, typically an option is to have the brokerage firm put it in a fund targeted for retirement at a certain date. You should use that option and set it for at least 60. What they do is put the money in more aggressive (but higher yielding) investments when you’re younger and start to scale back the risk as you approach 60 until it’s in fairly safe investments.

The Stock Market

This is where you put all the money that you save beyond your emergency fund. Especially these days where it costs $0 per trade to buy/sell stocks. And you should be saving AT LEAST 10% of your paycheck, maybe including the money you set aside to get your matching 401k benefits at work if you have that.

So, put that money in the stock market. How, you ask? It’s easy. Open a brokerage account at a company like E*TRADE, TD Ameritrade, or whoever. Link that to your bank account, and start transferring all your extra money beyond the emergency fund here. What do you invest in? I’m not a professional, not licensed to give advice, so do your own research and invest in things that you personally use or believe in. Personally, I like tech, so if I’m lazy and don’t want to pick a particular stock I tend to buy an ETF that follows the NASDAQ 100, like QQQ. The S&P 500 is probably a little safer, and one ETF that follows that is VOO. But again, I am not giving investment advice here, you MUST do your own research and buy whatever you think will go up. Those ones I like could do horrible things and you could lose your money.

One piece of investment advice I can legally give is that I like this website: https://www.investopedia.com/ They have a lot of great articles on all sorts of investment strategies. When you get older you want to start moving your money out of stocks because they’re fairly risky and start putting it in something safer. Bonds are typically something people use for this, but hopefully by the time you’re older you have a fat pile of cash and you’ve got time to read about investing and can figure this out for yourself. Basically, if that time comes, and you have enough money for this to be a concern- you are smart enough to have paid attention to the rest of this article and therefore I believe smart enough to figure this bit out on your own.

Borrowing for Large Purchases

Generally for every large expense you should be thinking about “what would my finances be like down the road if I pay for this in cash now, or if I got a loan at a low interest rate and kept investing my money instead?” Think about compound interest, always.

Car

For an example of thinking about compound interest, suppose you’re investing in something like the S&P 500 which has averaged 10% per year since 1950 and you’re looking to buy a new car where they’ll give you a loan for up to 3-4%. Would it be smart to pull 30k out of your brokerage account at 10% and just buy the car flat out? No, that would be a pretty bad decision. Take that cheap loan for as long as they’ll give it to you, and keep as much of your money in the market growing as you can! Yeah, the market could take a downturn and you’ll lose money on the deal and wish you hadn’t listened to this. But over the span of your life, you will be ahead on this deal- IF (and perhaps it’s a big IF) the stock market continues to go up as it has since it started. If the market goes in the tank for 50 years, all bets are off anyway.

Anyway, let’s continue with our example where you get a 3% loan and you’re getting 10% on an investment. Say the car is $30k and you get the maximum loan length (you want that cheap money as long as they’ll give it to you), so your payment is ~$396 per month. So the calculation is you start with 30k (that you would have wasted paying to them up front) and you withdraw $396 per month, and you make 7% per year on the money you keep invested over this time. At the end of those 84 months (7 years), you’ll have $6132 (in today’s dollars because we adjusted for inflation) in your account that you wouldn’t have had if you’d proudly given them your money like a non-wealthy person would. Which is, of course, what happens to poor folks who scrimp and save to get money together to buy a car and proudly not have a loan. First, they get nailed by inflation over the few years they’re saving up as they save in cash or in a savings account, then they throw that 6 grand in the toilet. They think they’re doing pretty well because they bought a car outright, and they’re partly right because they’re not paycheck to paycheck at least, but they could be doing better still.

Here’s another fun example. Suppose you want to buy that 30k car but you’re only getting a 6 year loan at 3% (a low number that assumes some manufacturer incentive), then your payment would be $457. They have a 2 year old car of the same model but there’s no help from the manufacturer and your credit isn’t stellar so you are offered a 6% loan for 6 years, but the car is $27,500 instead of 30k. You’re better off right? Nope, you’d be looking at the same payment for the same time. You could have a new car for the exact same cost. You really have to do the math, and fortunately there’s calculators to do this for you- you just have to plug in the numbers.

Again, I’m not an investment advisor, and this is a risky proposition for someone at retirement age (probably not smart if you’re over 60), but if you’re young you could be quite a ways ahead by following this strategy for a while in life. Always think about compound interest when you’re looking at any proposition involving a lot of money- like buying a car, boat, airplane, etc.

House

A house is similar to a car with regards to compound interest payments. If you’re young, personally I’d say you should put down as little as possible, taking into consideration the PMI (google it) penalty vs the profits you’d make investing your money. If you’re in the military, I believe you can buy a house with nothing down and not get PMI- I really wouldn’t put anything down in that case, no matter how much you’ve got saved. Unless you can’t tolerate risk, which will of course hurt you because you miss out on investing.

The biggest difference between a car and a house, is that a house is not a depreciating asset (a fancy term that simply means something loses value over time). But they really don’t go up as much as people think on average (yes yes, some markets are hot and can go up a lot, good luck) when you adjust for inflation. See my earlier discussion on “Your House” for how inflation factors in.

Basically, if you decide to buy a house, my opinion is you shouldn’t put any extra money into the down payment or monthly payments like a lot of people will tell you to do. The reason is that you should be investing any extra money in something like the stock market that goes up faster than houses do. At least they have for a long long time- which legally I must remind you could change at any time and you could lose all your money, etc. etc. But you could lose all your money in a house too. Just ask people in Detroit. If you want to keep breathing, life is a risk, choose wisely. I’m just suggesting one might consider investing their money in places that are generally known to make more money.

This assumption must be tempered by your interest rate. If you have terrible credit and are getting a home loan at something sick like 8+%, then you should put every dollar you get into paying off that mortgage as fast as possible. Because as you know from previously, the compound interest on that 8% is eating you alive. If you’re in that boat, you should REALLY consider renting until you fix your credit.

As of November 2019, rates are around 3.5% though for a 30 year fixed. Never get another type of loan, I don’t have room to explain why here, but just know that you should never get a variable rate loan. And if rates are low, then you sure don’t want a 15 year loan because you want that cheap money as long as they’ll give it to you so you can invest whatever you have left.

Another huge consideration for buying a house vs renting is how long you plan to be there. Conventional wisdom says you need to be there 7 years for it to be advantageous over renting. This might be a little padded in my opinion, but it’s not way off. If you can only commit to a few years, you should probably rent. The costs to sell a house are huge. If you buy a half million dollar house, the 6% alone that the real estate agents get is about $30k. Plus the other various fees and taxes and other crap you have to pay mean it takes a while before you’re gaining any ground over renting. So take a hard look at your plans, and your spouse’s plans, before you commit to buying a house. Be sure you’re going to stay there at least 7 years or you’re likely shooting yourself in the financial foot. The New York Times has a FANTASTIC calculator for buying vs renting that everyone who is thinking about buying a house should use: https://www.nytimes.com/interactive/2014/upshot/buy-rent-calculator.html You can consider the interest gained with your investment strategy on your money, taking into account various lengths of time you might be in the house, HOA fees, property taxes, and all sorts of things- and it will tell you the price point at which you should rent vs buy.

If someone tells you about the money you save on income taxes from the interest you pay, and how fabulous that is, and why it makes up for any part of this… just nod your head and when they’re done quickly go write yourself a note to ignore any financial advice from them that they’ve given you previously or do in the future. Why would you pay $10000 in interest to save $3000 in taxes??? Madness. If you want to throw away 70% of your money, feel free to donate it to me, I’ll take it. Don’t get me wrong, if you’re buying a house anyway, this tax break is nice! But you don’t buy a house and pay all that money in interest to get a tax deduction on the interest. That makes no sense at all.

Disclaimer

I am providing this content for informational purposes only. I am not a licensed financial advisor, CPA, or attorney- so you should not construe any of my opinions as financial, investment, tax, or legal advice. Nothing in this content is meant to solicit you to buy or endorse any particular security or financial instrument.

When I talk about a specific security, like “QQQ”, or an index like “S&P 500”, these are meant purely as examples to express a concept- not as advice to purchase those particular securities. There are risks inherent in almost any investment, you could lose everything you invest. Past performance is not a predictor of future success.

Basically, you should read this document, then go read a variety of other informational sources on managing your money, and make your own decisions. Things that worked for me may fail miserably for you. I provide this content “as is” without warranty of any kind. Again, I am not an expert, you should consult with a paid financial expert before making ANY sort of investment decisions. You should consult with a CPA before making decisions regarding taxes. The reason you should consult with a professional is that your specific situation may invalidate my ideas and make them less than worthless.

Appendix

This section is for other financial mistakes people make that will hinder growing wealth.

Insurance

Here’s the one sentence you need to know about insurance: never buy insurance for something you can afford to replace. I suppose the corollary is: do buy insurance for things you can’t afford to replace. Insurance has its place, it’s not evil for sure, but not for things you can afford to replace.

Think about how insurance companies make money- and they do make heaps of it. They charge you a small amount of money (often monthly) to replace something more expensive if something happens to it. It sounds like a great deal sometimes, but all you need to do to know you’re getting burned in the deal is to look at their buildings. Just like the banks, it’s obvious they’re making heaps of money off people. Who? You- their customers.

What does this tell you? It tells me that if you kept all those small amounts of money you paid for insurance on things like a phone, a TV, a dishwasher, etc. that you’d be keeping that money that would otherwise be making the insurance companies richer. Every once in a while when you drop your phone and it breaks, you use a portion of the money you’ve not wasted on insurance over the years, and just buy a new phone- you’re your own insurance company, and you keep the profits! Better still, there’s no hassle involved and no one to deny your claim.

What you can “afford” is the question, that’s where you draw the line. If you’re living paycheck to paycheck, then you probably can’t afford a new phone, so you have to buy insurance. Which, of course, helps to ensure that you keep living paycheck to paycheck. These sort of poor financial choices are what keep some people living paycheck to paycheck, and enriches those that profit from those choices. If you’re living paycheck to paycheck and you want to stop, I suppose first don’t go buy a new TV, but if you did at least don’t buy any insurance on it- you can live without a TV.

If you’ve at least got your 3 months of cushion going, then you shouldn’t be buying insurance on any of those above listed items (or items like them). Nor should you buy ANYTHING they try to upsell you with at the car dealership. Extended warranty- that’s insurance. Even if it cost you $5000 to replace the engine, you could afford that- it would suck, but you could afford that with your cushion. In the end, you will be ahead financially. Don’t buy a home warranty on stuff like your water heater, A/C unit, etc. You can afford to replace those things, keep that money!

If you have more money (like investments), don’t buy any vehicle insurance beyond liability insurance (that one is important because that can be huge). Don’t buy the insurance to replace a window, or send a tow truck, fix a dent- any of that crap. You can afford to pay that. Insure yourself and invest the profits.